There are things I learned long ago, things I’ve recently learned, and things I’m currently trying to wrap my brain around that I get asked questions about. When I finally work through something and figure it out I assume I was just dumb and stupid for not having understood it before and everybody else just already knew. However, I keep coming across people who have never heard this tidbit or that tidbit of knowledge I discovered... from other people or from my own stupidity that smarter people avoided. I do not have all of the answers, in some cases I just have boards covering potholes to prevent stumbling over things that should be avoided.

Debt is the currency of slaves.

Silver is the currency of gentlemen.

Gold is the currency of royalty.

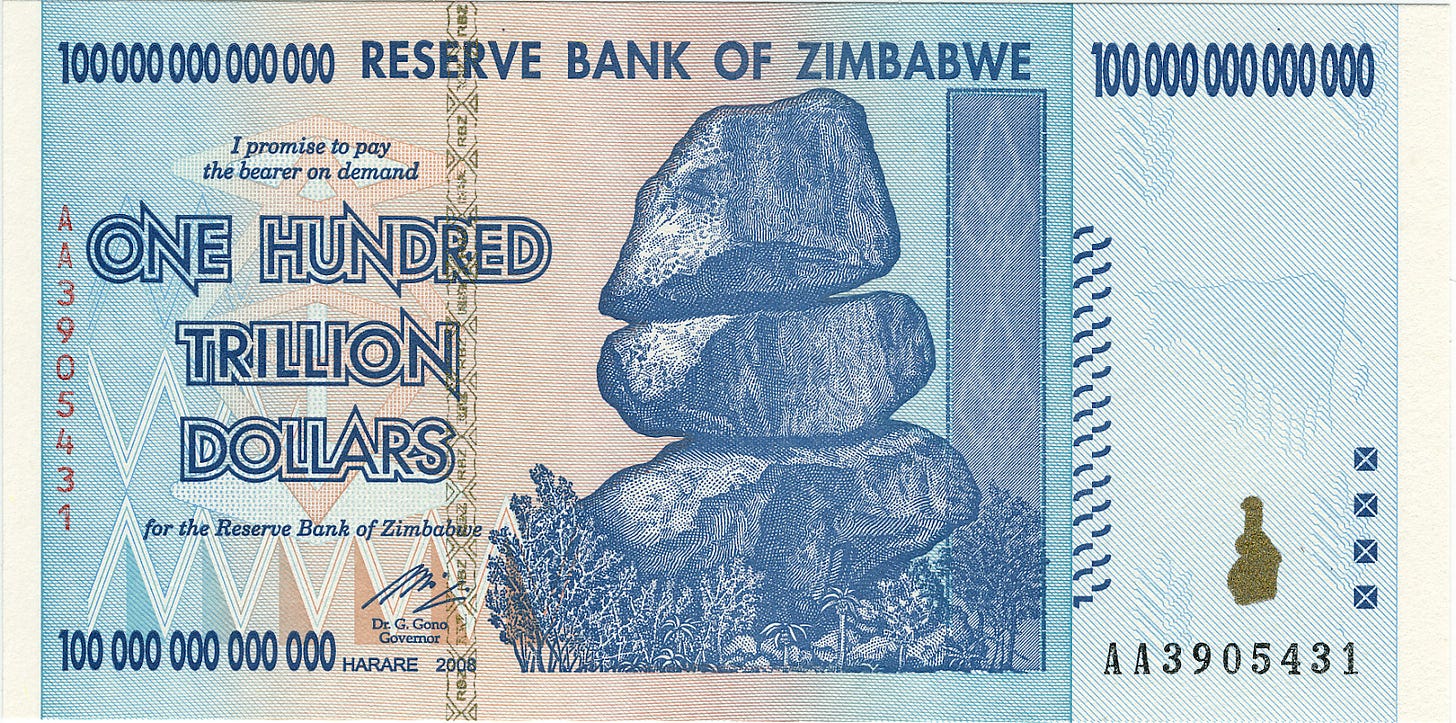

Gold and silver have been money and currency, or a battery storage of wealth (shout out to Bald Guy Money on YouTube), for thousands of years. Why do we need the shiny rock metal now that we have paper currency? Do we even need paper currency now that we have digits? Why are my digits buying less this year than last year? There are massive debates about Keynesian vs. Austrian Economics and all sorts of other ideas I’m not going to touch on and bore people with, but you should look up more information on these topics and study them.

For this, I’m going to stick to KISS… Keep It Simple.

What is the difference between these two 90% silver coins? Keep your answer really simple as I’m going to go through a couple of these so I’m not looking for a complicated answer.

What’s the difference between these two pieces of gold? Again, where I’m going with this is pretty simple so don’t make it too complex of an answer.

What’s the difference between these two pieces of 999 silver? Again, keep the answer simple.

What’s the difference between these two pieces of paper, a linen and cotton mix? There’s a picture of a different guy and the number is different? Notice that both are a Federal Reserve Note.

Gold is the money of kings.

Silver is the money of the people.

Barter is the money of peasants.

Debt is the money of slaves.

The first paper currency I’m aware of Congress issuing was Continentals. It was valued against the different State monies at different rates. Five Georgia shillings, six New Hampshire shillings, all the way up to 32 and a half South Carolina shillings. Unfortunately monetary policy hadn’t been coordinated between Congress and the States and the States continued to issue their own bills of credit.

Between 1775 and 1778 they had lost the majority of their value and were only worth 1/5th to 1/7th their original value. As an example, if we were to think of today’s dollars, each dollar would only be worth around 14 to 20 cents of its original dollar value. Congress tried removing them from circulation and reissuing paper currency again, but they were worthless. Benjamin Franklin noted that the depreciated value had effectively acted as a tax to pay for the Revolutionary War. Quakers, being pacifists, had forbidden the use of the “war notes”. Imagine being paid your daily wage only to find out when you got to the grocery store they wouldn’t take your money or if they did they’d only accept it for pennies on the dollar.

An even newer currency note was then funded by bullion coins loaned from France, then the notes were backed by a personal loan and line of credit, then a further $450,000 loan in the form of French silver coins. The Bank of North America notes were convertible into gold or silver.

The inflation and collapse of the Continentals led to the addition of the silver and gold clause to the Constitution so that the individual states could not issue bills of credit or "make any Thing but gold and silver Coin a Tender in Payment of Debts".

The United States passed the Coinage Act of 1792 defining the weight of silver in a US Dollar which pegged it to the commonly used Spanish silver dollar. Coins were minted in various sizes including some we use today like Quarters and Dimes, but in silver.

Any person could bring gold or silver bullion and have it coined for free or exchange it immediately for an equivalent value of coin. Trying to continue to do business with foreign coinage would cause both parties to be fined $10 and the foreign coins would be confiscated. That $10 was a lot of money back then as it was half of a $20 gold coin!

United States Treasury Notes were issued during the War of 1812 and then irregularly up through the Civil War as a temporary short term method of dealing with debt. The polite fiction was that they were not money, but they behaved as such. The Treasury Notes would rapidly disappear from circulation once the crisis that caused their creation ended. They were an embarrassment of debt that was paid off as the government was able.

The American Civil War saw a massive printing of not just Treasury Notes, but also Demand Notes in smaller dollar amounts. Demand Notes allowed the bearer to demand an equivalent weight of gold or silver to the amount of Demand Notes turned in. Unlike the Treasury Notes, the Demand Notes were allowed to be directly re-issued.

All of this Debt Printing happily continued until the Trent Affair caused a scare that the Union would not only have to deal with the Civil War, but might also end up in another war with Great Britain. When it was discovered that the Civil War was going to last longer, gold coins started disappearing from circulation. Eventually even the silver and copper coins vanished from circulation as people decided to hold onto the wealth and simply traded the possibly worthless paper money.

After the Civil War the government voted to buy back all of the outstanding paper currency (about $400 million), but a bad harvest, a financial panic in Great Britain, and a contraction of the money supply caused a massive bout of deflation and prices fell. Arguments went back and forth, but Congress eventually voted to allow for the keeping of paper money as a reserve to counteract seasonal demands for currency. The Greenbacks had a revised limit of $300 million and were backed by gold, on demand! This tying the value of paper to gold strengthened the value of the paper currency and eventually their valuation matched the silver coinage and the silver coins reappeared in the market.

Treasury Notes, Demand Notes, and United States Notes were known as “Certificates of Indebtedness”. United States Notes were issued from 1862 to 1971 and after a certain point were considered Silver Certificates - payable to the bearer in silver. United States coinage had been made in gold, silver, nickel, and copper. The silver coinage was 90% silver all the way up through 1963. During World War 2 there was such a large need for nickel and copper that the 5 cent nickel became 35% silver and copper pennies were replaced with steel. Gold was made illegal and the government asked people to turn it in, those that did got paper money which almost immediately lost its value as the gold to paper ratio was changed. There were only a few people that were reported for keeping gold and a few of those were thrown in jail or fined and had all of their gold confiscated.

In 1964 the Treasury stopped redeeming Silver Certificates for silver dollars. Over the next couple of years they instead issued silver “granules” that would equal the amount of silver that would have gone into the coins. All silver redemption ended before the 1970s.

The rich rule over the poor, and the borrower is slave to the lender. - Proverbs 22:7

I’m stopping this article here as there are so many different directions to take this and I want this to be a starting point. Even trying to keep this short I rambled into and through the Civil War. I plan to write more short articles with hopefully some useful tidbits to think over.