There are things I learned long ago, things I’ve recently learned, and things I’m currently trying to wrap my brain around that I get asked questions about. When I finally work through something and figure it out I assume I was just dumb and stupid for not having understood it before and everybody else just already knew. However, I keep coming across people who have never heard this tidbit or that tidbit of knowledge I discovered... from other people or from my own stupidity that smarter people avoided. I do not have all of the answers, in some cases I just have boards covering potholes to prevent stumbling over things that should be avoided.

I was going to start this with a hypothetical $1,000 USD in the bank, but I realized not everybody can grasp that just yet. Maybe I can start at $100 USD, but with younger generations, like my niece and nephew or younger kids, they may not have that yet either. I think it’s probably best to just start with a $10 bill. The irony of Hamilton.

What is money? It’s supposed to be a store of value. If I can buy a dozen eggs for a dollar or I can get items off the McD’s dollar value menu today I could get ten dozen eggs or ten items on the value menu. I should be able to keep that $10 bill in the bank and expect that I can still get that many eggs or that many dollar value menu items tomorrow. At least that seems to be the expectation?

Instead I head over to the store tomorrow and the dozen eggs or the item on the dollar menu is $1.10... Well ok, it's just a little bit more. The day after it’s $1.20, then $1.50, then $2, then $3, then $5. Wow, it must be getting really hard to find and dig up that dozen eggs or the dollar menu item because the scarcer a resource becomes the more the value goes up... right?

There are multiple reasons for this, but in this article I’m just going to touch on inflation. What is inflation and how does it affect our currency? People outside of the United States invest in Federal Reserve Notes (aka U.S. Dollars) because it's been a more stable currency than their own local currency. What does this mean? How does this work?

Most of the currencies in the world right now are fiat currencies, what many of us would call paper money. There are both pros and cons to this. One of the easy pros for carrying around paper currency is the weight. Imagine trying to carry around a pound or two of copper in order to pay for a burger at a fast food restaurant? How about showing up with one hundred troy ounces (almost seven pounds!) of silver to buy a used car?

In a previous article I pointed out how the United States fiat currency used to be linked directly to gold and silver. That is what actually gave the fiat currency value. Why is this important? Money represents a value of work in some way.

If we go back to ancient Roman currency, somebody had to mine the ore. Then someone refined the ore. Someone converted the refined ore into a coin. The value of the material and size of the coin also gave it value. The material money, made into coin, to be currency and easily spent. The coin had value outside of the realm because of the inherent value of the material. When Rome started reducing the amount of silver in their “silver” coins the coins became worth less and less. In some cases the original older coin had 94% silver content and the newer and newer coins ended up with 60% or less silver content allowing Rome to “print” more coins.

Now if we look at one of the most infamous fiat currencies, the German Weimar Republic’s mark, we might be able to learn something. In 1914 the exchange rate was about 4.2 marks per U.S. dollar and the government started borrowing money to fund their war effort. By 1918 the exchange rate was about 7.9 marks per U.S. dollar. What was worse was after the war they kept printing more and more marks without anything of value behind it. The printing got so bad that in order to not run out of ink they gave up trying to print both sides and only printed the one side. By the end of 1923 the exchange rate was 4,210,500,000,000 marks per U.S. dollar (copied from Wikipedia). That’s four trillion and some odd marks per dollar!

This problem is not relegated to only countries losing a massive world war. The Turkish lira is a recent currency I saw a video about on YouTube a couple of years ago. Stores had to keep changing their prices throughout the day as the value declined. People would get paid right before they would go on their lunch break and hope the currency kept its value long enough to buy lunch. Your afternoon shift would pay you more and hopefully you could buy dinner. The next morning your pay rate was even higher than the day before because the value had dropped even more. Most stores ended up posting prices in US dollar amounts and simply converted for lira on the fly.

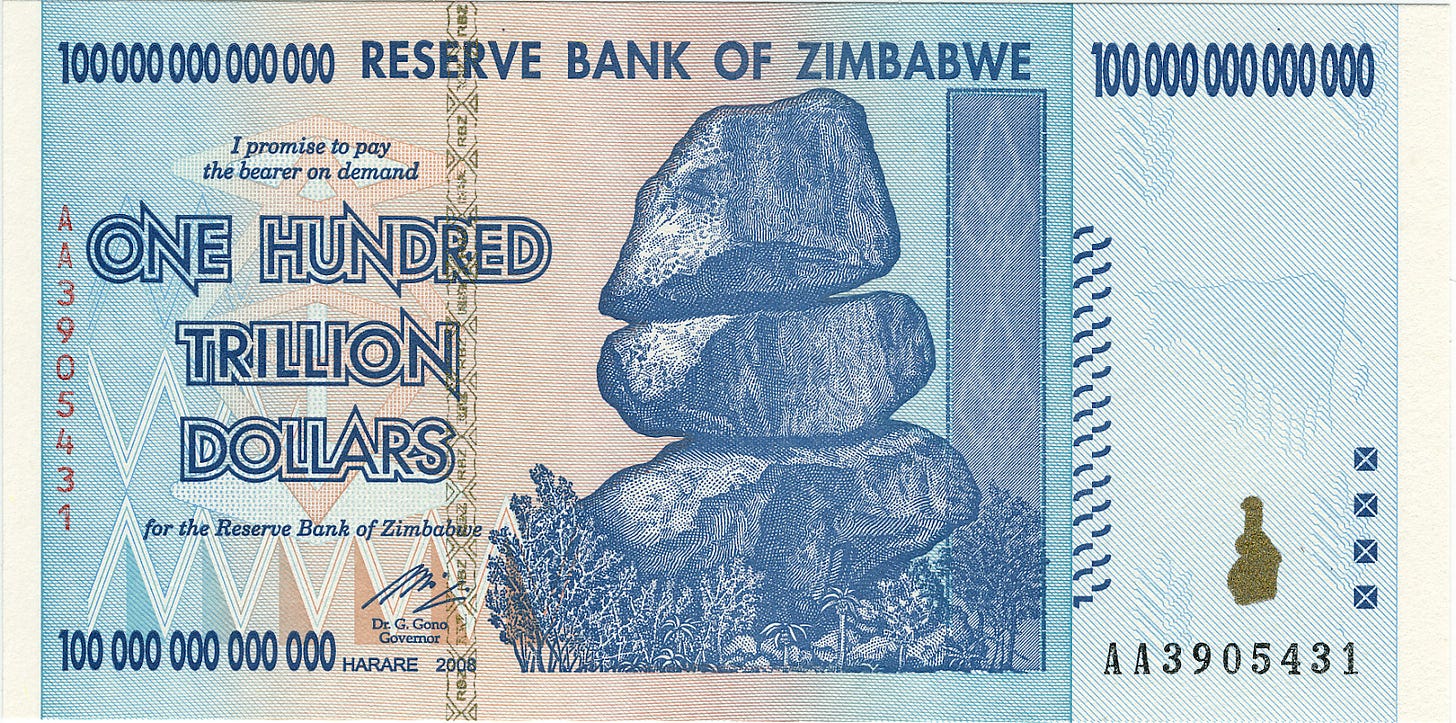

Another country that has had problems with printing too much currency is Zimbabwe. They printed so much currency they’re famous for having the one hundred trillion dollar note. It was worthless, so they created a new currency and within a few years they were right back to having printed trillions of dollars of notes. They are now trying to grapple with a gold backed fiat currency.

When U.S. dollars were silver certificates (and even when they were backed by gold) they were limited to how many they could print based on how much gold and silver the U.S. government had. At a certain point in time the U.S. government removed the gold backing which left the 90% silver coins in the system. Then, in 1964, even the 90% silver coins were removed from the system.

If instead of looking at currency as a store of value you instead look at it as a product... Things start to change. When a product is scarce and in high demand in the marketplace, the value goes up. When a product is no longer scarce and is no longer in high demand, the value goes down. Even if the product is scarce, but nobody wants the product, the value will also go down.

Trying to comprehend the massiveness of what is going on is difficult so let’s break this down to be a bit more comprehendible. For every one hundred U.S. dollars ($100) currently in the system, whether physically printed or just a digit in your bank account, twenty dollars ($20) existed before the year 2020. That leaves the remaining eighty dollars ($80) in that one hundred ($100) was just created in the last four years… And they’re still creating more.

Mathematics show no forgiveness on the alter of truth.

I will end this here after giving a brief mention and warning about BRICS. BRICS originally stands for Brazil, Russia, India, China, and South Africa, but more and more countries are signing onto this international trade agreement. The original BRICS members make up about 30% of the world’s land surface and 45% of the world’s population. These countries were previously utilizing U.S. dollars which lessened the impact of inflation on U.S. citizens.

With these countries extricating themselves from the usage of U.S. dollars they are shipping the inflation back to the United States. The chickens are coming home to roost and dealing with the decades of inflation is going to be painful.